In the ever-evolving landscape of financial services, finding the right advisor is crucial. Whether you’re planning for retirement, managing investments, or seeking expert guidance on financial matters, the internet has become an invaluable resource. With countless websites and platforms offering financial advice, it can be challenging to discern the best among them. That’s where DIGITALON comes into play.

DIGITALON, a leading online platform, has been diligently curating a list of the top financial advisor websites in Australia. With a focus on quality, reliability, and expertise, DIGITALON’s list is a go-to resource for individuals and businesses seeking financial guidance. In this comprehensive article, we will unveil the top 20 financial advisor websites in Australia, as recognised by DIGITALON.

Content

The Criteria for Selection

Before we dive into the list, it’s essential to understand the criteria used by DIGITALON to evaluate and rank these Financial Advisor websites in Australia. The selection process is rigorous and involves a thorough assessment of various factors, including:

1. Expertise and Reputation

The reputation and experience of the advisors behind the website are paramount. DIGITALON looks for advisors with extensive industry knowledge, certifications, and a track record of providing sound financial advice.

2. Content Quality

The quality and relevance of the content on the website are crucial. This includes articles, blog posts, videos, and other resources that offer valuable insights and guidance to visitors.

3. User Experience

The user-friendliness of the website is another significant factor. Navigating the site should be intuitive, and the design should enhance the overall user experience.

4. Client Testimonials and Reviews

Real-world feedback from clients is invaluable. Positive testimonials and reviews from satisfied customers indicate a high level of service and trustworthiness.

5. Range of Services

The breadth of financial services offered by the advisors is considered. Whether it’s wealth management, retirement planning, tax optimisation, or other financial services, a comprehensive offering is a plus.

6. Innovative Solutions

DIGITALON also looks for websites that embrace technology and offer innovative solutions, such as online calculators, financial planning tools, and interactive resources.

The Top 20 Financial Advisor Websites in Australia

Now, let’s unveil the list of the top 20 financial advisor websites in Australia, curated by DIGITALON:

1. Mgdic.com.au

MGI Dobbyn Carafa is an innovative organisation committed to driving positive and transformative change in its clients, employees, and the accounting field through collaboration and partnerships. Since its establishment in 2006 as Dobbyn and Carafa, the founders envisioned more than just a client-focused business; they aimed to cultivate strong partnerships within their staff. Joining the MGI Worldwide network in 2019 expanded their access to networks and growth opportunities for both clients and employees. In 2021, the firm introduced the Pathway to Partnership Program, granting equity to six of its most talented leaders, resulting in a substantial portion of the staff becoming co-owners of the firm.

Furthermore, the launch of the MGI Graduate Program in 2022 underscores their dedication to professional development and collaboration, reinforcing their identity as MGI Dobbyn Carafa as they embrace an exciting future with the next generation of leaders.

Website:https://mgidc.com.au/

2. Eendorphinwealth.com.au

Endorphin Wealth specialises in offering strategic wealth management services and solutions. Their team of financial advisors possesses a wealth of expertise across various facets of personal wealth management, which includes asset and wealth investment management, investment counsel, estate planning, and capital wealth management. The firm places a strong emphasis on meticulous attention to detail and diligence when it comes to delivering wealth services. They leverage dedicated resources and external investment research to identify optimal investment opportunities that not only enhance returns but also minimise risk for their clients. Safeguarding capital throughout the wealth management process is a paramount objective, and they deploy defensive strategies whenever feasible.

At Endorphin Wealth, the clients take centre stage. The firm brings extensive experience in navigating complex entity and asset structures, fostering close collaboration with their clients’ preferred accountants and specialists to achieve exceptional outcomes. Client satisfaction and financial well-being remain at the forefront of their mission.

Website:https://endorphinwealth.com.au/

3. Listonnewton.com.au

Liston Newton Advisory had its humble beginnings as a sole trader venture in Donald, a regional town in Victoria. With a remarkable journey spanning over four decades, the firm has diligently cultivated a sustainable and ethical enterprise. Today, it proudly extends its footprint, with a presence established across three offices throughout the state. What truly sets the firm apart is its dedicated team of individuals, all of whom share an unwavering passion for enhancing the value of their clients’ businesses.

Guided by new and dynamic leadership, and marked by a comprehensive rebranding initiative, Liston Newton Advisory is eagerly embracing the future. With its extensive history as a foundation, the firm is poised for exciting new horizons. They are brimming with enthusiasm, looking forward to forging fresh and strategic collaborations with business owners. Their aim is to pinpoint opportunities that will not only facilitate the growth of both personal and business wealth but also usher in a new era of prosperity and success.

Website:https://www.listonnewton.com.au/

4. Timothyfinancial.com

Timothy Financial Counsel, founded in 2000, is a highly reputable fiduciary fee-only financial planning firm that places its clients’ best interests at the forefront. They stand out by offering comprehensive financial planning rather than just asset management and billing exclusively for the time spent meeting clients’ needs. They are unique in making expert investment advice accessible to individuals, regardless of the size of their assets, and they never receive commissions for their recommendations.

The firm distinguishes itself with a collaborative team approach, ensuring high-quality advice by collectively assessing each client’s financial plan. They prioritise transparency and client-centricity, making their fee structure readily available for clients to review and offering a no-obligation introductory consultation. Timothy Financial Counsel’s commitment to crafting comprehensive financial roadmaps, avoiding asset management fees, and providing tailored, client-focused services makes them an excellent choice for prospective clients seeking financial planning expertise.

Website:https://timothyfinancial.com/

5. Deltafinancialgroup.com.au

Delta Financial Group is deeply committed to assisting its clients in achieving financial prosperity and realising their life aspirations. The firm’s approach is centred on a collaborative partnership with clients, aimed at crafting a personalised and strategic blueprint. This blueprint is meticulously designed not only to minimise tax obligations but also to optimise investments and savings, all with the ultimate goal of efficiently growing clients’ wealth. Additionally, when feasible, the firm works towards helping clients achieve the dream of early retirement.

What truly sets Delta Financial Group apart is their unwavering dedication to making their clients’ life achievements the top priority. Their financial experts understand that every individual’s financial journey is unique, and they tailor their services to reflect this reality. This client-centric approach ensures that the strategies and solutions offered are aligned with the specific aspirations and goals of each client.

The firm’s commitment to delivering personalised financial guidance goes beyond just managing finances; it’s about empowering clients to live the life they’ve envisioned. Delta Financial Group believes that financial success is not just about numbers but about making dreams a reality.

Whether it’s securing a comfortable retirement, funding a child’s education, or realising any other life ambition, the firm is steadfast in its mission to provide the expertise and support needed to turn these dreams into tangible achievements.

In summary, Delta Financial Group stands as a trusted partner on the journey to financial prosperity and life fulfilment. Their collaborative, personalised, and goal-oriented approach ensures that clients are not just on the path to financial success, but also on the road to realising their life’s aspirations.

Website:https://www.deltafinancialgroup.com.au/

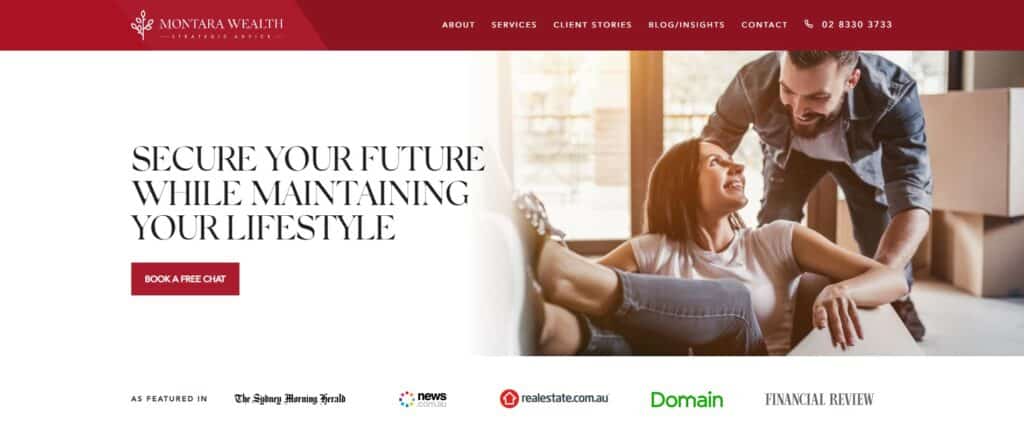

6. Montarawealth.com.au

Montara Wealth stands as a distinguished independent financial advisory firm, dedicated to collaborating with a diverse clientele, including individuals, families, and businesses. The primary objective is to develop comprehensive financial strategies that encompass a wide spectrum of financial aspects, ranging from prudent investments and smart savings to meticulous retirement planning and more.

The hallmark of Montara Wealth’s approach is the delivery of holistic and strategic guidance. The firm’s mission is to empower clients to achieve not just financial stability but also a profound sense of financial security. To achieve this, Montara Wealth meticulously crafts personalised financial blueprints that are finely tuned to address both immediate, short-term financial goals and long-term aspirations.

A notable aspect that sets Montara Wealth apart is its unwavering independence. The firm operates without any affiliations or ties to financial institutions or banks. This independence ensures that the advice and strategies provided are solely in the best interest of the clients, free from any external influences.

Montara Wealth takes pride in its areas of specialisation, which encompass a wide array of financial domains. These include:

- Cash Flow Analysis and Modeling: A thorough assessment and meticulous modelling of cash flow to optimise financial decisions.

- Investment Tactics: The firm excels in formulating investment strategies, which may include investments in index shares and direct property, aimed at maximising returns and minimising risk.

- Superannuation Planning: Expertise in designing superannuation strategies to secure a comfortable retirement.

- Tax Planning: The firm offers tax planning from an investment perspective, helping clients minimise tax liabilities.

- Estate Planning: Crafting strategies to effectively manage and transfer assets as part of estate planning.

- Insurance Planning Strategies: Implementing insurance solutions that safeguard clients’ financial well-being, tailored to their unique circumstances.

In essence, Montara Wealth is not just a financial advisory firm; it’s a trusted partner in clients’ financial journeys. The firm’s dedication to providing personalised, independent, and comprehensive financial guidance underscores its commitment to helping clients achieve their financial aspirations and secure their financial future.

Website:https://montarawealth.com.au

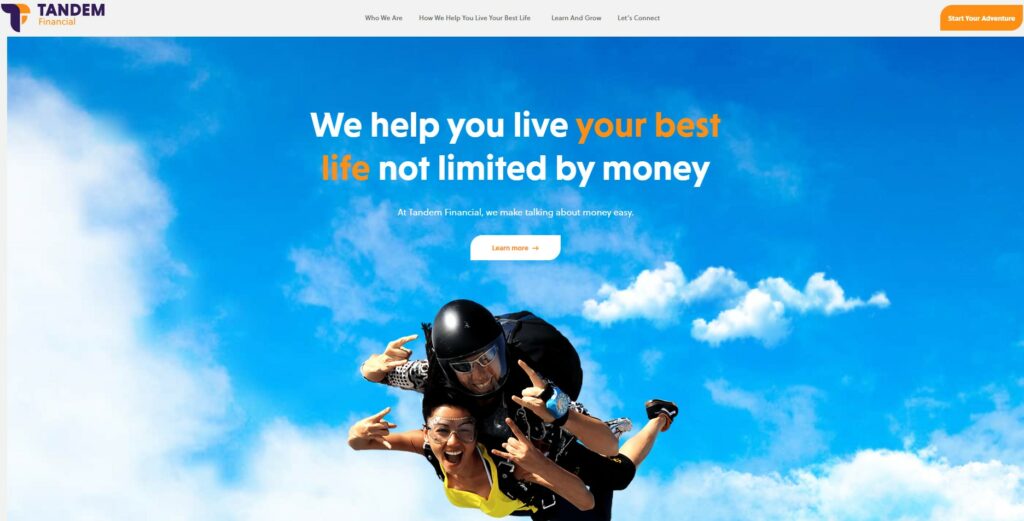

7. Tandemfinancial.com.au

Mankit Tsang assumes the pivotal role of Director and Financial Adviser at Tandem Financial, bringing to the table an impressive track record of over 15 years in the Financial Services industry. Throughout his career, Mankit has distinguished himself by providing expert guidance to a diverse clientele, hailing from various backgrounds and walks of life. His dedication to helping clients navigate the complexities of finance is underscored by his innate affinity for numbers, and he finds immense satisfaction in tackling financial challenges and assisting clients in forging their path towards lasting financial stability.

Mankit’s formative years were steeped in a culture of modesty and hard work. He grew up in an immigrant family, alongside three supportive siblings who shared in life’s trials and triumphs. His parents, both diligent immigrants, epitomised resilience as they toiled tirelessly to provide for their family. His father’s long hours as a Pastry Chef and his mother’s unwavering commitment to managing household responsibilities served as a testament to their unwavering dedication. Their journey of hard work and perseverance eventually led to a well-deserved retirement several years ago.

Beyond his professional endeavours, Mankit holds family values in the highest regard. He treasures the precious moments spent with his wife, Elise, and their two children, Estelle and Mason. Family bonding is a top priority for him, and he dedicates any available free time to creating culinary delights by experimenting with new recipes or exploring dining experiences. Additionally, Mankit frequently embarks on family outings, with the beach ranking among their favoured destinations for relaxation and rejuvenation.

In tandem with Mankit’s financial expertise, Tandem Financial benefits from the exceptional management skills of Jin Lim, who serves as the Practice Manager. Jin plays a pivotal role in ensuring the seamless operation of the organisation. She proactively upholds the strength of the firm’s systems and processes, guaranteeing that Tandem Financial consistently fulfils its commitments to its valued clientele. Her dedication to operational excellence complements Mankit’s financial acumen, making Tandem Financial a well-rounded and reliable partner in clients’ financial journeys.

Website:https://tandemfinancial.com.au/

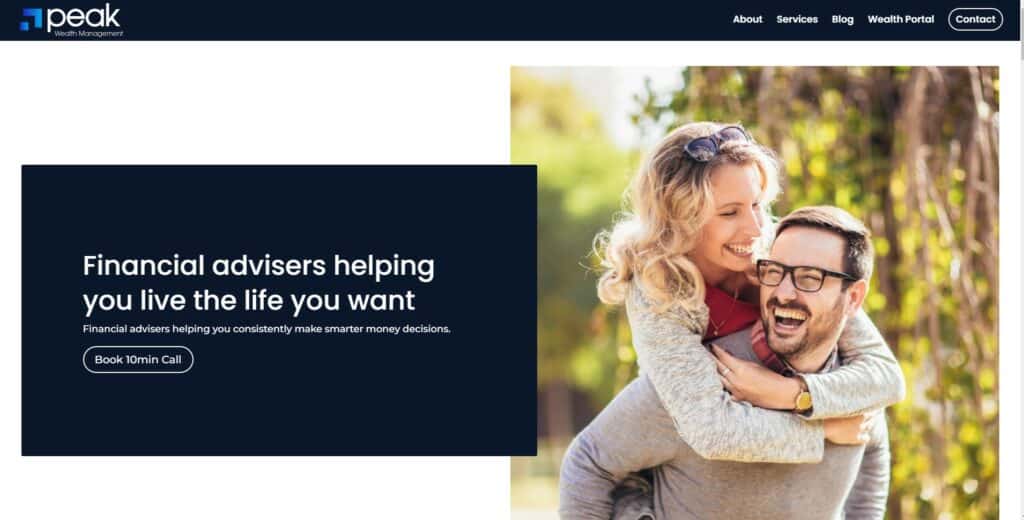

8. Peakwm.com.au

Peak Wealth Management Financial Advisers, located in Sydney, is dedicated to providing individuals with comprehensive financial guidance in a systematic and proven manner, all geared towards achieving long-term financial success. Their approach to financial advice encompasses several key principles:

- They craft holistic, thorough, and individualised financial plans, carefully tailored to expedite each client’s unique journey towards financial prosperity.

- Diversification is a key component of their investment strategy, with a focus on spreading investments across various asset classes. Their approach takes into consideration factors such as asset protection, asset intent, and asset tax status.

- Peak Wealth Management aims to minimise tax liabilities for their clients by structuring assets in the most tax-efficient manner possible, ensuring that clients retain more of their hard-earned money.

- The firm offers personalised insurance solutions designed to provide protection in various scenarios. For instance, they offer Income Protection plans to safeguard clients in cases where illness or injury prevents them from working for an extended period.

- Clients benefit from a meticulously tracked, refined, and visually presented cash management strategy that allows for real-time monitoring of financial growth and progress toward financial goals.

- Recognising that individuals at different stages of life have unique needs, risks, and objectives, Peak Wealth Management tailors financial plans to align with each client’s current life stage.

- The firm also assists clients in understanding their financial habits, both positive and negative, and collaborates to mitigate risks and behaviours that could potentially disrupt their financial plans.

Website:https://peakwm.com.au/

9. Foxandharewealth.com

Fox and Hare Wealth collectively possesses over 30 years of extensive experience within the financial services industry. Rest assured, they have all aspects of their clients’ financial well-being meticulously covered.

What sets their advisory service apart is the dedicated support structure in place for each adviser. Behind every adviser stands a specialised team known as a ‘pod,’ consisting of four highly skilled financial services professionals. These professionals operate with unwavering focus, committed to bringing their clients’ unique advisory journeys to life as efficiently and effectively as possible.

When a client chooses one of their advisers, they are not just benefiting from the individual expertise of that adviser; they are gaining access to the collective knowledge and resources of the entire pod. To delve further into the comprehensive support and talents at the client’s disposal, all that is needed is to click on their chosen adviser’s profile. This simple action reveals the full spectrum of resources and capabilities within the pod, ensuring that clients receive the highest level of financial guidance and service tailored to their unique needs and goals. The team is dedicated to providing clients with the utmost confidence in their financial journey, knowing that their future is in capable hands.

Website:https://foxandharewealth.com/

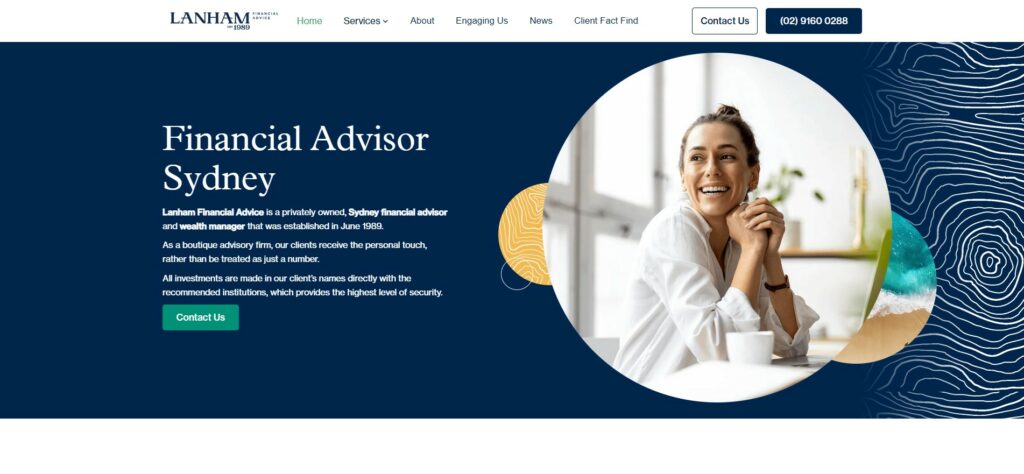

10. Lanham.com.au

Lanham distinguishing itself from larger financial firms, this boutique practice takes pride in offering a personalised touch that truly sets it apart. Privately owned and operating with an unblemished record since 2000, the firm holds its own licence, ensuring complete independence from any bank or financial institution. This independence is a cornerstone of their operation, guaranteeing that the financial advice provided remains free from any external bias or influence. Clients can rest assured that the counsel they receive is consistently in their best interests, devoid of any hidden costs or commissions.

At the heart of this boutique practice is a commitment to providing exceptional personalised advice. The firm is not merely focused on financial matters; it places paramount importance on understanding the unique life aspirations of its clientele. The clients who seek the expertise of this practice are discerning individuals with a genuine willingness to receive advice and an unwavering desire to realise their life goals.

In essence, this boutique practice is more than just a financial advisory firm; it’s a dedicated partner on the journey to achieving life aspirations. With a strong emphasis on personalised, unbiased advice and a track record of operating independently, clients can trust that their financial well-being is in capable hands. Whether it’s securing a comfortable retirement, funding a dream vacation, or pursuing any other life aspiration, this boutique practice is committed to providing the guidance and support needed to make those dreams a reality.

Website:https://www.lanham.com.au/

11. Ffg.net.au

Empire Financial Group stands as a reputable financial planning firm dedicated to offering strategic financial planning advice through a transparent and client-centric approach. Their commitment to providing comprehensive, fee-for-service financial guidance is unwavering, making their services accessible to clients of all ages and stages in their investment journey.

One of the cornerstones of Empire Financial Group’s approach is their dedication to crafting customised strategies that align with each client’s unique financial situation and aspirations. They understand that financial goals vary widely, and they tailor their advice to suit these diverse needs. Whether it’s planning for retirement, funding a child’s education, or achieving any other financial objective, Empire Financial Group is steadfast in providing goal-oriented strategies designed to turn those aspirations into reality.

What sets Empire Financial Group apart is their promise of long-term support and guidance. They embrace a team-based approach, pooling the expertise of their financial professionals to ensure that clients receive the most well-rounded and informed advice possible. This collaborative effort underscores their commitment to achieving the best possible outcomes for their clients’ financial futures.

Transparency is a core value at Empire Financial Group. They are resolute in maintaining product and investment-class neutrality, ensuring that their clients’ interests always come first. This commitment to impartiality is further reinforced by their fee-for-service model, which guarantees that clients receive advice and support that is entirely in their best interests. There are no hidden agendas or conflicts of interest; the focus is solely on the client’s financial well-being.

In summary, Empire Financial Group is more than just a financial planning firm; it’s a trusted partner on the journey to financial success. Their comprehensive, client-tailored strategies, team-based approach, and unwavering commitment to transparency ensure that clients receive the guidance and support needed to secure their financial future. Whether clients are just starting their investment journey or have a well-established portfolio, Empire Financial Group is dedicated to helping them navigate the complexities of finance with confidence and clarity.

Website:https://www.efg.net.au/

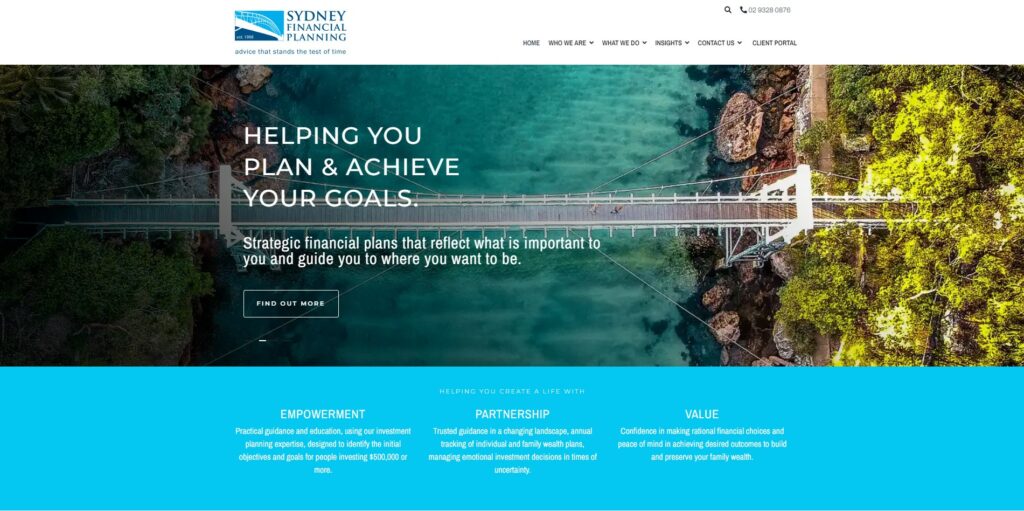

12. Sydneyfinancialplanning.com.au

Established in 1988, Sydney Financial Planning boasts a rich history of serving clients throughout Australia, with offices located in New South Head Rd, Edgecliff, and Princes Highway, Corrimal.

The firm’s team of specialist investment planning advisers offers a comprehensive range of financial services, including investment advice and planning, ownership structuring and taxation strategies, pre-retirement planning for accumulators, retirement incomes planning, tax minimisation, superannuation advice, children’s education planning, and strategic property advice and planning.

For those seeking their initial consultation, a fee of $99 applies, providing an opportunity to explore the firm’s services. Following this, an initial advice fee of $3,900 is applicable upon the implementation of the initial financial plan. Sydney Financial Planning also offers ongoing plan tracking services and investment advice, starting at $292 per month, with the added benefit of being tax-deductible.

William Bracey, the Senior Financial Planner and Principal at Sydney Financial Planning, stands as a highly esteemed professional in the field. His accolades include recognition as one of the Most Trusted Advisers Network awardees from 2013 to 2015, and he was honoured as the recipient of the Gerald Lippman Award in 2019.

Beyond their financial services, Sydney Financial Planning is actively engaged in various charitable endeavours, notably supporting the Sir David Martin Foundation through fundraising campaigns since 2014.

The firm is lauded for its dedicated care and effort in serving each client, with consistently positive feedback from past clients serving as a testament to their commitment to excellence.

Website:https://www.sydneyfinancialplanning.com.au/

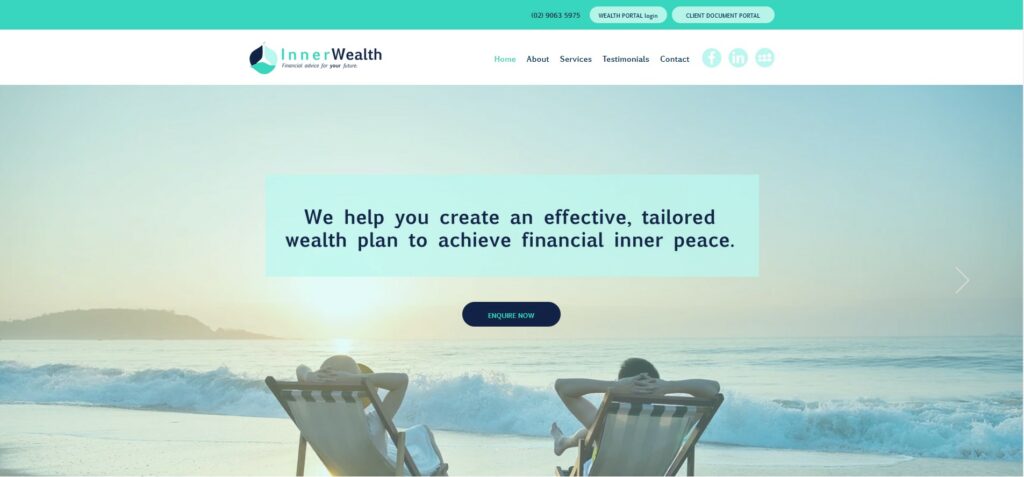

13. Innerwealth.com.au

In 2020, Tony Lu founded Inner Wealth Solutions, marking the inception of his own financial planning venture. Prior to this, Tony had accrued valuable experience within the financial industry, having worked with prominent financial firms. He began his career as a transition service consultant at ING in 2003 and subsequently assumed the role of senior financial planner at Infocus Advisory Australia in 2005.

Tony’s career achievements have earned him recognition as one of the elite financial advisers who have attained the esteemed status of Most Trusted Adviser. He has also earned the Certified Financial Planner (CFP) qualification, further solidifying his expertise and dedication. His consistent recognition as one of the Top Financial Planners in Sydney, as assessed by Adviser Ratings, speaks volumes about his professional prowess. Additionally, in 2017, he achieved a noteworthy top-six ranking in the AFA

Website:https://www.innerwealth.com.au/

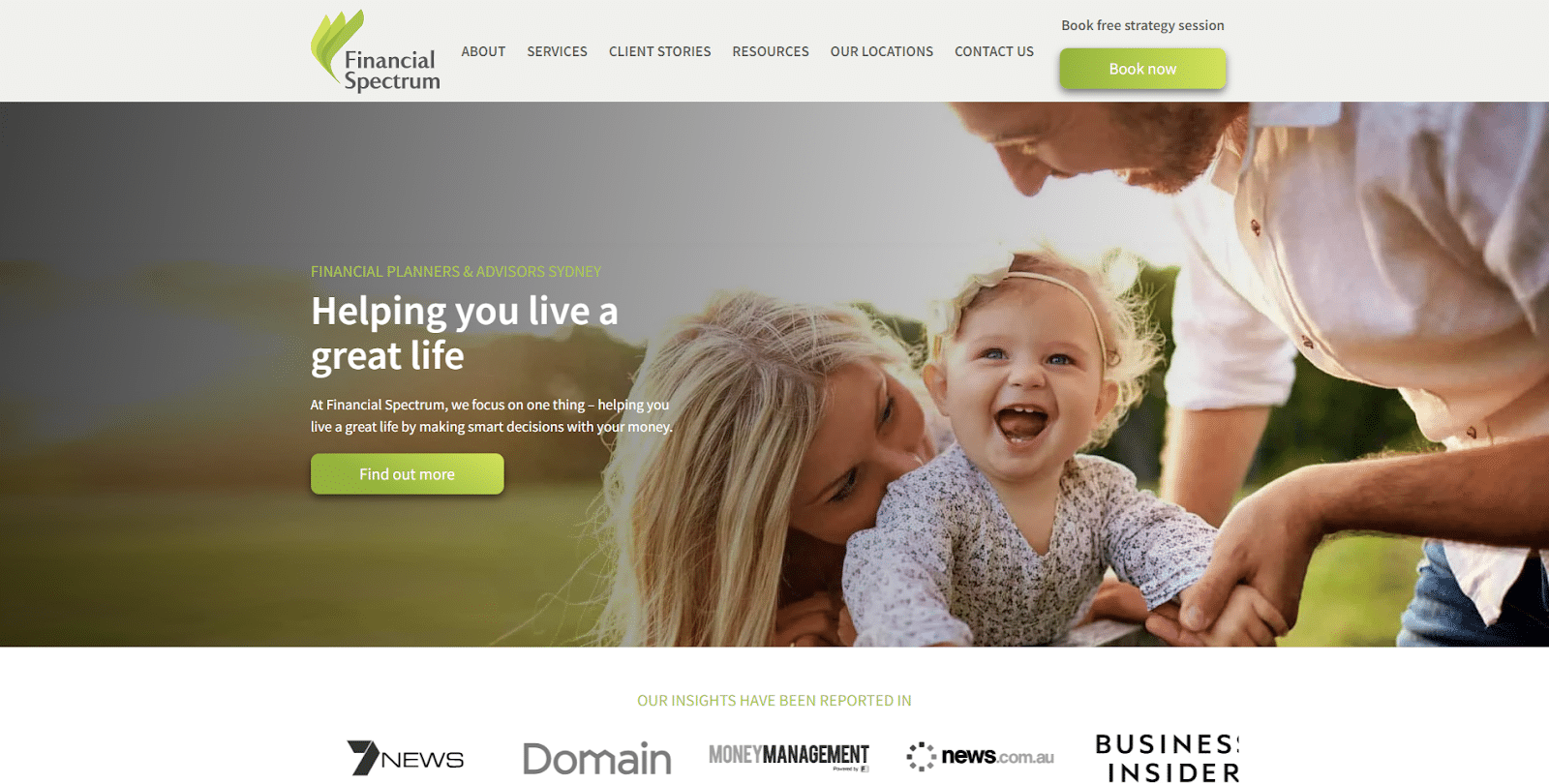

14. Financialspectrum.com.au

Established in 2013, Financial Spectrum is a privately-owned firm with a presence in Balmain, Bondi Junction, and Sydney CBD. They hold the esteemed Certified Financial Strategist accreditation and proudly maintain memberships with the Association of Independently Owned Financial Professionals as well as the Association of Financial Advisers (AFA).

Financial Spectrum offers a comprehensive range of financial services, encompassing financial advice, financial planning, strategic financial modelling, insurance, budgeting, cash flow management, superannuation, tax minimisation, self-managed super funds (SMSF), property investment, transition to retirement, estate planning, mortgage and borrowing guidance, business advisory services, and accounting.

At the helm of Financial Spectrum is Brenton Tong, serving as the managing director and senior financial adviser. Brenton is a distinguished member of several reputable organisations, including the Association of Financial Advisers, the Responsible Investment Association of Australia, and the Association of Financial Professionals. Additionally, he holds the status of a FINSIA senior associate member and consistently garners recognition as one of Sydney’s top financial planners.

Under Brenton’s astute leadership, Financial Spectrum has been instrumental in disseminating financial insights across various media outlets and private institutions. Their expertise has been featured in esteemed platforms such as 7 News, Domain, Money Management, News.com.au, Business Insider, The Sydney Morning Herald, The Age, Yahoo Finance, ABC, Financial Review, and Brisbane Times.

Website:https://financialspectrum.com.au/

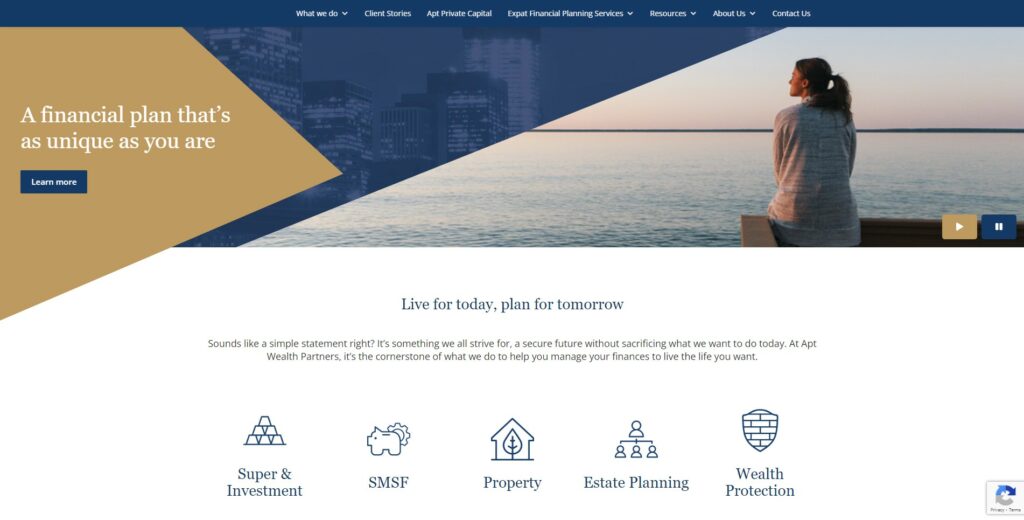

15. Aptwealth.com.au

Apt Wealth is a highly acclaimed financial planning firm that operates based on a set of six core principles, namely transparency, growth, protection, diversification, strategic timing, income optimisation, and cost minimisation.

Under the leadership of James McGregor and with the collective expertise of the entire Apt Wealth team, the firm offers an extensive array of services. These services encompass estate planning, superannuation, home loans, wealth protection, retirement planning, aged care planning, divorce planning, redundancy planning, and more.

Apt Wealth has earned a slew of prestigious awards, including the 2021 Professional Practice of the Year award, recognition in the 2021 Financial Standard 50 Most Influential Advisers list, and the 2019 Certified Planner of the Year accolade, among others.

In keeping with its commitment to innovation, Apt Wealth has introduced BeApt, a suite of cloud-based tools designed to empower individuals and couples in monitoring and managing their finances effectively, thereby enabling them to better prepare for their financial future.

Website:https://aptwealth.com.au/

16. Jacarandafp.com.au

Jacaranda Financial Planning is a well-established firm operating across New South Wales and Victoria, boasting a wealth of over three decades of experience in delivering top-tier financial advice to its valued clientele in these regions.

Among the founders of Jacaranda FP is Brett Stene, whose career in the financial service industry commenced in 1986. Over the course of the past thirty years, Brett has emerged as a key figure in the research and strategy operations of various adviser groups. His extensive career journey has seen him contribute significantly to the development of innovative financial products, serve on multiple boards, engage in funds management, provide international lectures and consulting services, and much more.

Jacaranda FP offers a comprehensive range of personal and general financial advice and services. These encompass diverse financial instruments such as stocks and bonds issued by government agencies, debentures, deposit and payment products, derivatives, foreign exchange contracts, general insurance products, investment products issued by life companies, investor-directed portfolio services, margin lending facilities, investment schemes, life insurance products, securities, and superannuation.

To ensure accessibility and convenience for clients, Jacaranda FP extends an offer of a free initial consultation. This allows individuals to have their financial situation assessed without incurring any charges, making it an excellent opportunity to explore the valuable services the firm can provide. It’s an offer that won’t cost you a penny, and it may just be the first step towards achieving your financial goals.

Website:https://www.jacarandafp.com.au/

17. Abacuswealthsolutions.com.au

Abacus Wealth Solutions, located in Liverpool, specialises in providing financial planning services to a diverse clientele, including retirees, pre-retirees, families, businesses, professionals, and independent young individuals. Their primary objective is to assist these clients in building financial security through well-informed advice spanning various areas such as aged care, insurance, retirement planning, lending, and superannuation solutions.

Operating from two convenient locations, one in Liverpool and another in Leichhardt, Abacus Wealth Solutions stands out for offering some of the most competitive service fees available in the market.

For those seeking guidance, Abacus Wealth Solutions extends an offer of complimentary initial consultations. Clients can rest assured that their team of Certified Financial Planner (CFP)-certified consultants will not only listen attentively but also tailor their strategies to align with each client’s unique financial situation.

Should you wish to get in touch, the Abacus team, including John, Tracey, and others, can be easily reached via email or phone. They are committed to providing personalised and data-driven financial solutions to help you achieve your financial goals.

Website:https://www.abacuswealthsolutions.com.au/

18. Sfg.com.au

Shadforth is a financial advisory firm that specialises in delivering holistic, goal-oriented wealth advice aimed at helping clients attain financial independence. Their comprehensive range of services encompasses private wealth management, investments, retirement planning, insurance, estate planning, and business advisory.

When it comes to private wealth advice, Shadforth adopts a comprehensive approach that extends beyond investments. They utilise a total balance sheet perspective to support clients in achieving their financial objectives. Collaborating with leaders in the investment markets, certified financial planners at Shadforth tailor portfolios to meet individual needs and apply evidence-based principles to investment strategies.

The firm’s team of expert advisers is well-equipped to assist clients at various stages of life and in different circumstances. Whether clients are in the process of saving for specific financial goals, navigating complex life events such as divorce, or transitioning into retirement, Shadforths seasoned professionals are there to provide guidance and support every step of the way.

Website:https://www.sfg.com.au/

19. Twd.com.au

The Wealth Designers provide essential financial guidance aimed at assisting clients in wealth accumulation and achieving a fulfilling life. What sets them apart from others is a unique approach that emphasises listening to clients’ objectives, avoiding product-centric strategies, delivering substantial value, implementing a transparent flat fee structure, and fostering an inclusive atmosphere rather than an elitist one.

Their in-house investment team, in conjunction with a panel of experts, collaborates to present intelligent investment opportunities to clients. The company draws inspiration from the late Sharl MacMillan, renowned for his prosperous record store business founded on the principle of delivering an exceptional customer experience.

Website:https://twd.com.au/

20. Lifefinancialplanners.com

LIFE Financial Planners, headquartered in Perth, is a firm dedicated to delivering customised financial strategies and guidance designed to help clients realise their financial aspirations. The team at LIFE Financial Planners places great emphasis on forging close partnerships with clients, seeking to comprehend their values, articulate their objectives, and craft tailored financial blueprints geared towards achieving those goals. They take pride in offering continuous support and advice, ensuring that clients stay on the path to financial success and remain well-informed throughout their journey.

A core tenet of LIFE Financial Planners’ approach is a steadfast commitment to providing top-tier advice and ongoing service. The firm has garnered recognition for its exceptional client service, reflecting their unwavering dedication to client satisfaction. Moreover, as a member of the Association of Independently Owned Financial Planners, they uphold a commitment to delivering unbiased advice, free from conflicts of interest, further solidifying their trustworthiness and integrity.

Website:https://www.lifefinancialplanners.com/

Conclusion

Choosing the right financial advisor is a significant decision that can impact your financial future. The top 20 financial advisor websites in Australia, as unveiled by DIGITALON, offer a diverse range of expertise and services to cater to your specific needs.

While this list serves as a valuable resource, it’s essential to conduct your research and consider your unique financial goals and circumstances before making a decision. Reach out to these advisors, explore their websites, and take advantage of the wealth of knowledge they offer to make informed financial choices that will benefit you for years to come. Remember, your financial well-being is worth investing in, and DIGITALON is here to guide you on your journey to financial success.